Are Your Customers “Lost”?

I was attending a virtual vendor analyst event recently and as a part of the presentation customer journey maps, a mapping tool and journey map “templates” were demonstrated. In a back channel conversation with a colleague my aversion to the concept of a “journey map” came out in full force. Don’t get me wrong, I understand why it’s such a popular topic and approach to building out potential customer interactions. The fundamental issue though, is that the journey mapping is done based on what you want the customer to do, not what the customer actually does.

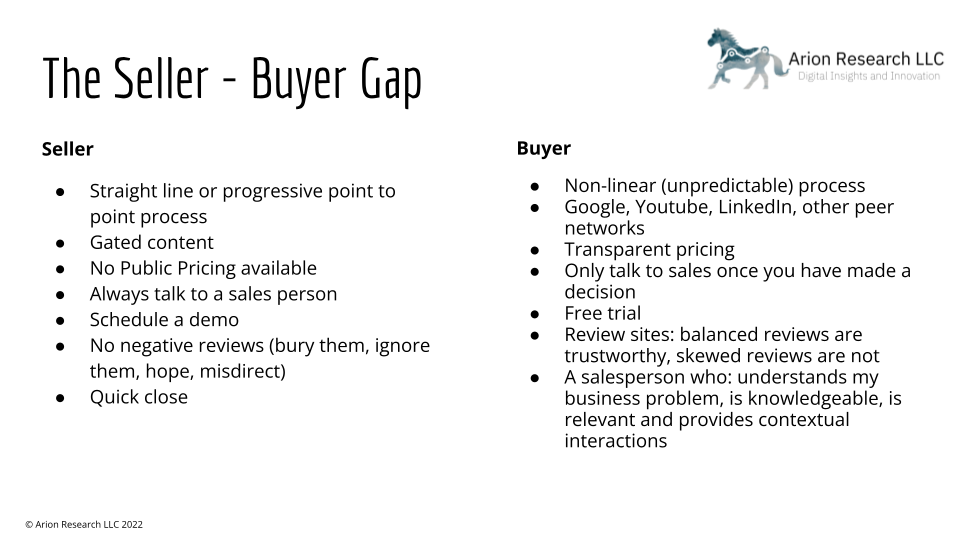

The Buyer - Seller Gap

For several years I’ve conducted survey based studies on changing business to business (B2B) buyer behavior; what buyers want, what they trust, and how they choose to research and buy things. I’ve learned quite a bit about buyers from the surveys and also from building out G2’s marketplace. Today, for a lot of companies and sales teams, there’s a gap between what they think the buyer wants and does, and how the buyer actually behaves. This gap creates bad or incorrect behaviors for the sellers, and creates friction and poor experiences for buyers. The gap looks something like this:

The journey “map” plays directly into this gap. The term itself is misleading, creating confidence that if I map it, the customer will follow it. Unfortunately when you talk to companies they are often perplexed as to why selling seems to get harder every year. Outdated sales tactics like cold calling are less and less effective, buyers don’t want (and have control of) irrelevant (or likely irrelevant) conversations with BDRs and sales reps. What buyers do want is timely, relevant, contextual information from a partner that spends the time discovering what the buyers’ problems are, and has an effective way to solve them. Looking at the journey map exercise how should it change to help close the buyer - seller gap?

If journey maps aren’t the correct approach, what can you do to modernize your go to market plans? The first step, I think, is to admit that you do not and can not control the customers’ path to purchase. The best you can hope for is to utilize data and provide experiences that encourage the customer to interact with you, and provide you with enough behavioral clues to help you tailor your approach. This method helps address the typical non-linear customer journey, and transitions it from a “map” paradigm to a “model”.

In the G2 buyer behavior survey published in 2019, nearly 70% of the respondents reported “only contacting a sales rep after they had made their buying decision”. When asked about being contacted by a sales rep with contextual and relevant information, nearly 65% indicated they would welcome the interaction. Changing your approach to one that provides relevant and contextual information to the prospect should close the buyer - seller gap. While that sounds great, executing it probably appears nearly impossible to most companies.

Behavior-based Experience Model

The methodology for closing the buyer - seller gap is based on building a behavior based experience model. That model is based on as complete a data picture of a prospect or customer as possible. In other words the project of building an experience model starts at the data. If you already have a customer data platform (CDP) deployed to integrate all your customer related systems then you can go to the next step. If not, you need to integrate all your existing customer data / application silos to understand what data you have and what data you need to support the model.

Once you know what data you have (and can get to it), you need to identify as many potential interaction points with the customer as possible. Mapping the potential interactions to the data will identify your data gaps, which will need to be filled from internal and external data sources. Once the data profile is as complete as possible, you can build out the first version of the model, showing all interaction points, the behavior that the customer might exhibit and the potential responses from the company. I say “first version” because the model is iterative and should “learn” over time as you collect real time and near real time data on the behavior trigger : response : outcome sequence of each interaction. Identifying the “right” behavioral triggers, interpreting them accurately and creating all the potential responses varies greatly in complexity based on product or service being sold, the types and number of ideal customer profiles (ICPs) and the overall complexity of the sales process. The data to drive the response can be at the individual level or, for some interaction types and behaviors anyway, at the segment level.

The growing availability of artificial intelligence (AI) and particularly machine learning (ML) tools offer the capability to automate some of the model and some of the refinement of the model with more effective data analysis. Using AI to build predictive models can greatly increase the accuracy of response and increase the chances of a positive outcome to each interaction. Like all AI projects, the accuracy of the model is dependent on having complete, accurate data.

Relevant Systems

My intent isn’t to list all the possible systems that might be involved in the use of the model, but I do want to highlight a few tools that can accelerate your modelling exercise and improve your ongoing outcomes. The first tool is one I’ve already mentioned in this post, a CDP. There are a great number of good reasons to implement a CDP, I won’t list them all (I’m happy to discuss them though, if you are interested), but in this context, the CDP forms the foundation of your customer model. The CDP should also contain the AI tools needed to increase the accuracy of your analysis and move to a predictive model. If your CDP doesn’t fill the AI void, you can also look to adding an AI platform, which has the added benefit of having a broader set of use cases across the business. Depending on your product or service, or your sales model, you will likely need a product analytics platform as well. You will need one or several methods of integrating systems as well. There are so many approaches which vary greatly based on the specific system needs and requirements that I won’t try to address them all, but there are some very good integration platforms available as well as many API marketplaces.

The last tool I would recommend may seem a little out of context, an AI enhanced discovery focused sales acceleration platform. In a recent study by the Brevet Group, they reported that only 13% of customers believe that salespeople understand their needs. In other words, you likely have a problem with your sales team and their ability to discover and understand the prospects needs. A next generation AI enabled sales acceleration platform can help close this discovery gap. I wrote more about it here.

There is a lot more to building and using an effective customer model, much more than I can possibly cover in a single blog post. If I’ve peaked your interest feel free to reach out, we can assist in developing the strategy and the model.